Join The Wisdom of Warren Buffett

7 hour summit!

Learn why Warren Buffett is the most successful Stock Investor of all time with a staggering Net Worth of over 150 Billion USD

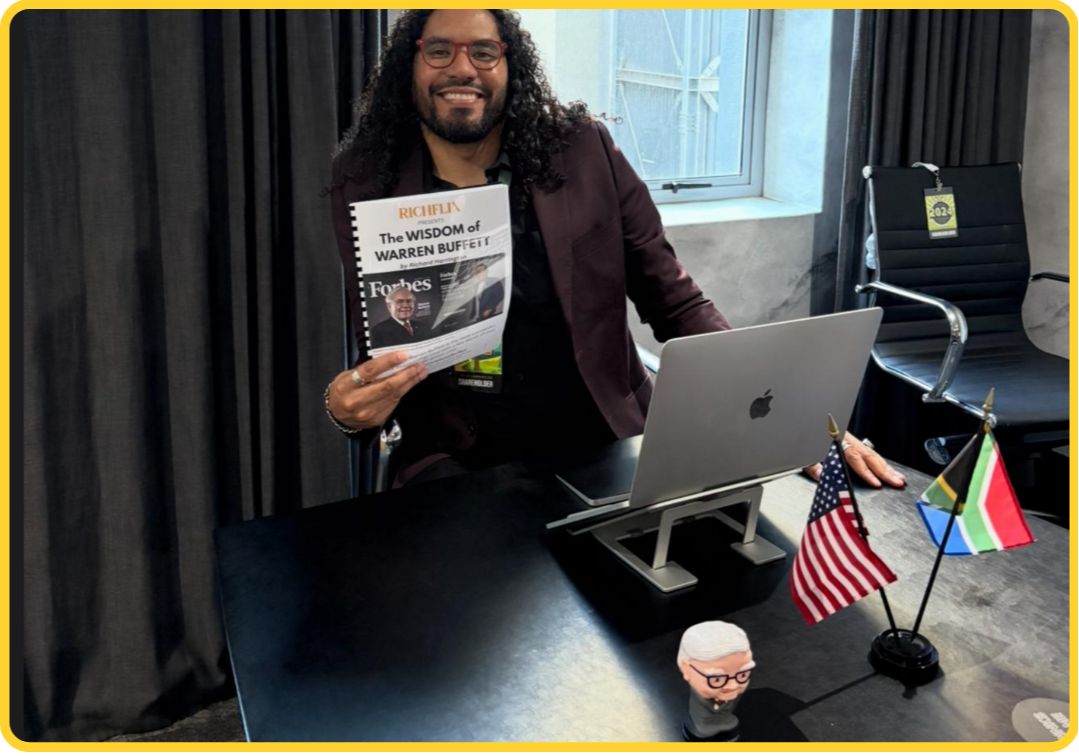

Summit speaker, Richard Harrington was featured alongside Warren Buffett in Forbes AND has learned directly from Warren Buffett at the shareholders meetings in OMAHA, Nebraska USA!

Virtual & Live Event | Saturday April 4 2026

⏰Times For The Summit - US Pacific: 6am to 1pm \ US Eastern: 9am to 4pm \ UK Time: 2pm to 9pm \

South Africa & Europe: 3pm to 10pm

$499 $247

Early Bird tickets close on March, 7th 2026.

All ticket holders will receive the full recording in case you miss the live event due to timezone challenges.

Important: This summit is NOT for short term traders, crypto, bitcoin but ONLY FOR LONG TERM INVESTORS.

1,000+

Purpose-driven

Attendees

1+

World-class

Speaker

1+

Transformational

day

Wisdom of Warren Buffett seven hour Agenda

- Welcome: Introduction, Course Preview

- The Artist: The Leonardo da Vinci of investing, How to Think Like Warren Buffett

- The Canvas: His Mona Lisa, Understanding the Berkshire Hathaway System

- Implementing Buffett’s Universal Principles in Different Markets and Countries.

- INSIDE WARREN BUFFETT’S TOP 10 Most successful Stock purchase of all time

- BONUS Q&A Session afterwards - Get all your burning investment questions personally answered by Richard Harrington in real time!

Disclaimer:

Nothing on this website or associated links should be taken as financial advice, but is for educational purposes only. Historical return is not a guarantee of future performance. No specific outcome or profit is guaranteed.

Please consult external sources before making any financial decisions.

Richard Harrington is a shareholder in Berkshire Hathaway Inc.

FAST ACTION BONUS:

If you purchase the Early Bird ticket now we will send you a never before released one hour investment training video of what Rich learnt at The Annual Berkshire Hathaway Shareholders meeting directly from

Warren Buffett at no extra charge!

The proof is in the pudding,

Well in this case the proof is in the portfolio.

Since 1965 when Warren Buffett took control of

Berkshire Hathaway, Berkshire’s stock significantly

outperformed the S&P 500 (returns up until 2024)

Berkshire's stock returned 5,502,284%

compared to the S&P 500's 39,054%.

Simply put, Berkshire's compounded annual return nearly

doubled the S&P 500's,

at 19.9% versus 10.4%.

Put even more simply, had you invested $1000

in Berkshire when Warren Buffett took the helm in 1965,

it would be worth an eye-popping

$44.7 million at the end of 2024!

The same investment in the S&P 500 would have grown

to just $342 906 over the same period.

Disclaimer:

Nothing on this website or associated links should be taken as financial advice, but is for educational purposes only. Historical return is not a guarantee of future performance. No specific outcome or profit is guaranteed.

Please consult external sources before making any financial decisions.

Richard Harrington is a shareholder in Berkshire Hathaway Inc.

The Summit was truly transformational

At Richflix our mission is to empower one billion people with the tools to set themselves financially free! Would you like to join the one billion Richflix tribe? Book your ticket now for this once in a lifetime opportunity live online summit!!!

What People Are Saying

Richflix 5 Star Google Verified Reviews

Our Tribe members success speaks volumes.

About Richard Harrington

Richard Harrington is the creator and instructor of the Wisdom of Warren Buffett Course as well as a Forbes featured Value Investor, International keynote speaker and distinguished authority on Warren Buffett. He is currently the Founder and CEO of Richflix Inc.

Harrington is a long term shareholder of Berkshire Hathaway Inc. One of Harrington’s greatest honors comes from being featured with Warren Buffett in a Forbes article titled, Investors Share Their Top Secrets of How to Profit During a Recession- With Warren Buffett.

Since 2009 when Harrington started investing in the stock market he has been applying Warren Buffett’s strategy of long-term value investing in all his investing decisions. One of his crowning achievements was presenting the investment lessons he has learnt from Warren Buffett on four continents- North America, Asia, Europe and Africa, culminating in a guest appearance on a morning tv show in Las Vegas!

For the first time ever Harrington has created a curriculum called The Wisdom of Warren Buffett. This one-of-a-kind program consists of a full day intensive based on what Richard Harrington has learned directly from Warren Buffett at the Berkshire shareholders meeting in Omaha, studying a decade of Warren Buffett’s annual letter to shareholders as well as reading nine books about Warren Buffett’s life.

A dedicated lifelong learner, Harrington holds an investment degree from the University of Stellenbosch.